Introduction

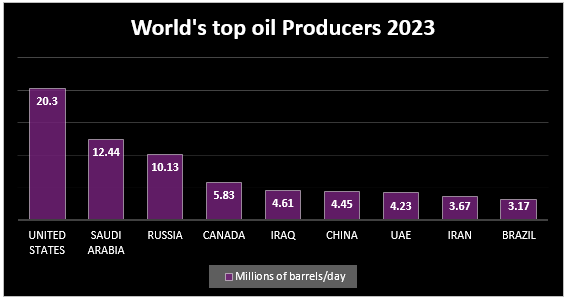

Canada is described as the world’s 4th biggest oil producer with 6% share of the global market (EIA.GOV 2023).

Figure 1: World’s top oil producers 2023 by author. Data from (EIA.GOV 2023)

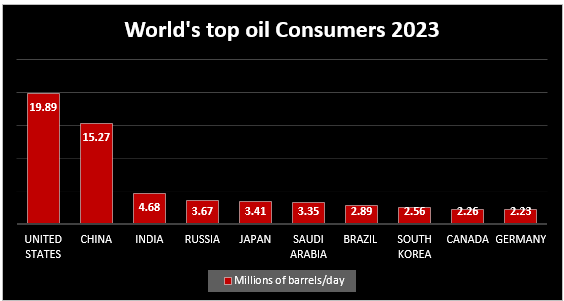

Figure 2: World’s top oil Consumers 2023 (EIA.GOV 2023)

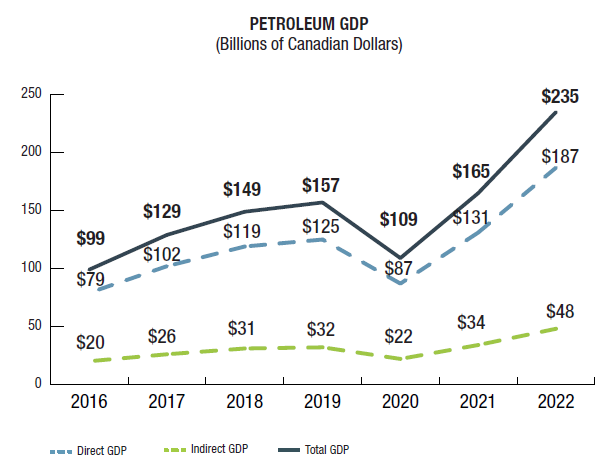

Canada is also among the top 10 biggest consumers of oil with all 10 listed countries consuming 62% of global oil production (EIA.GOV 2023), see Figure 2. This data is essential for me to highlight the role of oil in Canada’s economy today. Petroleum’s contribution to Canada’s GDP reached $235bn in 2022 as in Figure 6.

However, Canada has pledged to decarbonise its economy by 2050 (Government of Canada 2023).

Microeconomic theory: Elasticity of Supply and Demand

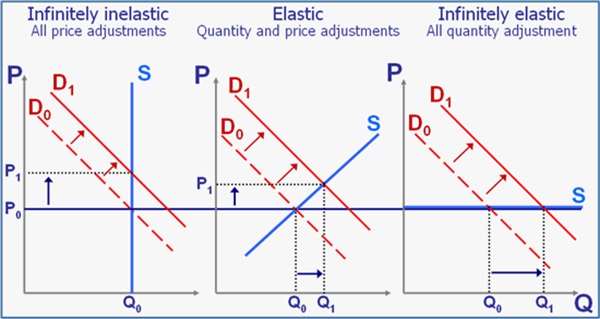

In summary, the theory of the elasticity of supply and of demand measures how sensitive the supply (S) and/or the demand (D) of a product of a service reacts to a change in price (P) (Kilian 2022).

Figure 3: Supply elasticity (World Bank 2010)

I will use this theory to explain the impact of the external factors listed on Canada’s oil economy.

Political and Economic Issues

The 3 most notable political and economic externalities that impacted on Canada’s oil economy as drivers of opportunities or threats are:

- Economic impact of COVID 19 Pandemic of 2020

- 2030 GHG reduction commitment 2021 – present

- Russian invasion of Ukraine in 2022 – present

COVID 19 Pandemic 2020

The pandemic resulted in the lockdown of economies across the globe which drastically reduced oil demand especially for transportation. Canada officially went into recession in 2020.

Impact on Demand and Supply elasticity in short run: Caldara, Cavallo and Iacoviello (2019) argues that in this situation, in the short run, oil supply elasticity will be zero which means it does not react at all the change in price, the resulting demand is -1 or inelastic which in that perfect condition of supply inelasticity, change in demand gives equal reaction to the change in price. This can explain why oil price went as low as -$37 in the short run.

Although Canada is not a member of OPEC and do not have any production commitment, this price crash as a result of decrease in demand, and surplus supply significantly impacted in the country’s GDP as shown in 2020 dip below:

Source Energy fact book (Natural Resources Canada 2023)

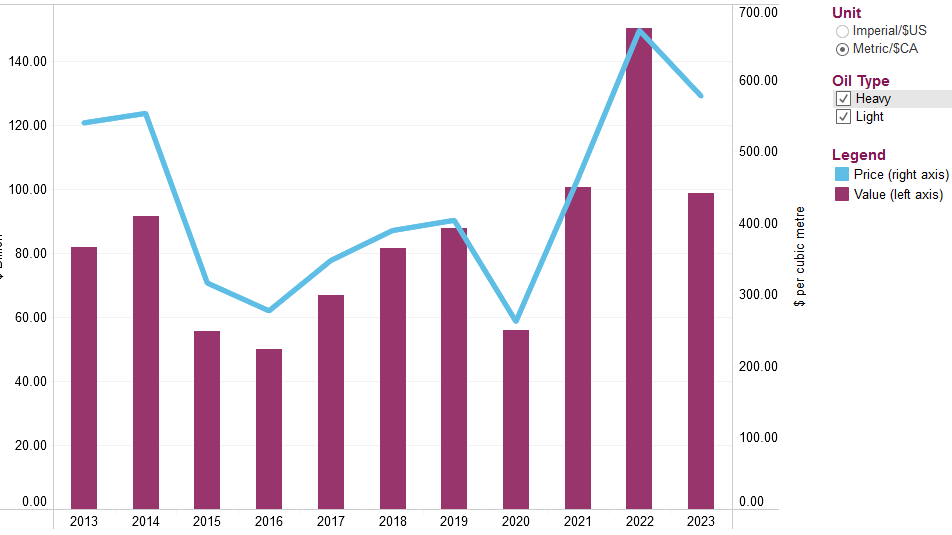

Canada’s exportation value for crude dipped from $86b in 2019 to $56b in 2020 which throws more light on the impact on the GDP:

Canada Average Crude oil export and prices 2023 (Canada Energy Regulator 2023)

2030 GHG reduction commitment 2021 – present

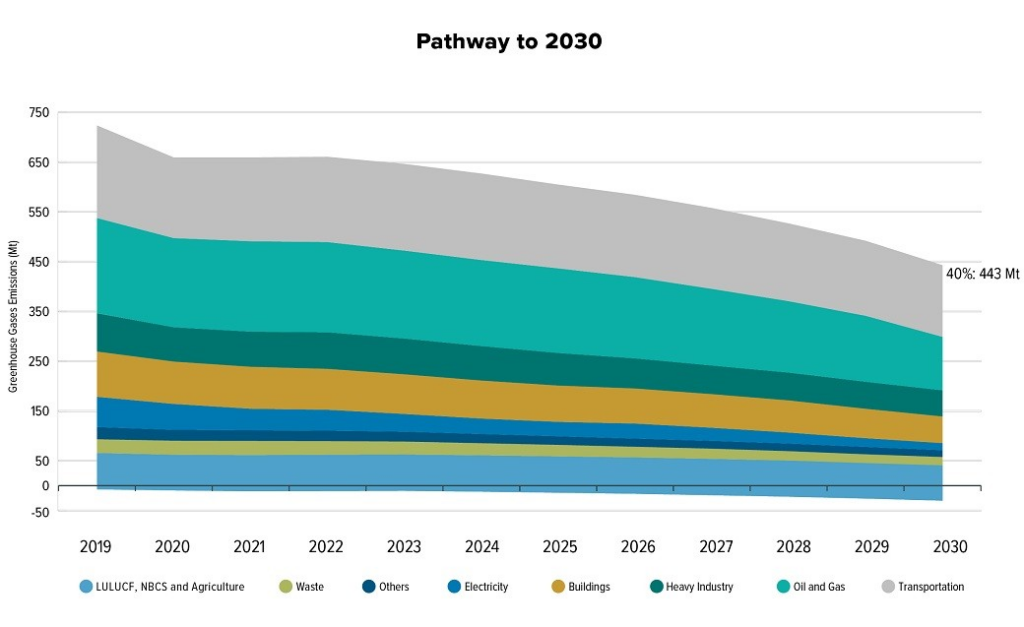

In 2021, Canada announced its Carbon reduction plan of 2030 as a step to actualising its 2050 net zero commitment.

Figure: Canada Carbon Reduction plan (Government of Canada 2023)

Impact on Demand and Supply elasticity of Canada oil economy:

In a new study of the uncertainties in Energy prices, Dokas et al. (2023) noted that the supply-demand equilibrium of oil is usually shifted by uncertainties and Government energy policies which results in varying energy prices. In this case, we can see that Canada intentionally (but gradually) is disrupting its oil economy with its green policies.

While I noted the inelasticity of supply in the short run in my analysis under COVID-19 Pandemic, I must add that while the Canadian government continues to commit to clean energy system as an alternative to Crude oil fuel, there will on the long run be a shift in demand to alternative energy which will make the supply of oil more surplus due to lower consumption but steady production and eventually, in the long run, the supply of oil will become elastic.

Russian invasion of Ukraine and other Geopolitical shocks

Although Real Business Cycle theory is concerned with technological shocks in the supply side as the main driver for economic fluctuations (Gazda 2010), we can also use that perspective to see the impact on oil price of long-term geopolitical tensions as the result of Russian invasion of Ukraine and other political instabilities including the Israel-Hamas war.

Using the principle of demand and supply, disruption in in Russia’s oil supply chain will certainly lead to scarcity of supply and increase in price in the global market. Again, refer to figure 7 to see that Canada’s oil export was highest in 2022 since 2013 in terms of value. This is linked to another positive externality of the war which is the increase in Canada’s GDP from $87b during the pandemic to all time high of $235b in 2022 (Figure 6). However, the negative externality includes uncertainties in the economy that led to increase in Bank interest (above 2% target since 2018) rate and subsequently increase in inflation in 2022.

Parallel in history

Because the Russian invasion of Ukraine is the major driver of Economic and sustainability led impact on Canada’s oil economy since 2022, I see a great parallel to it with the 1980-88 Iran-Iraq war which led to the scarcity of oil supply then. In the days of those scarcity and price increase, Tahmassebi (1986) noted that it revealed that OPEC was not in control of the oil market. However, Saudi Arabia and USSR reacted to this scarcity by increasing their production capacity which led to a drop in global oil price. I see the parallel today in Britain granting over a hundred new North Sea exploration licences (GOV.UK 2023) and the Prime Minister’s U-turn on several green policies (The Economist 2023) to encourage more oil production that will correct the supply scarcity created by the Russian war just like Saudi Arabia did in the Iran-Iraq war of 1988.

Challenges faced by Canada in transitioning to Hydrogen Economy

Canada’s commitment to the Paris Agreement includes cutting down greenhouse gas emissions by 30% by 2030 compared to 2005 levels (Government of Canada 2016). Hydrogen as an energy carrier is recommended as a potential silver bullet for clean energy transition especially in the high to abate sectors (Van Renssen 2020; IEA 2023). Also, due to the intermittency of solar and wind, Hydrogen is the preferred non-carbonaceous energy carrier of the future energy mix (Muradov and Veziroǧlu 2005).

Hydrogen can be classified based on its production method (Ocenic and Tantau 2023)

Common Classifications of Hydrogen fuel

Our discussion will focus on blue and Green Hydrogen.

Canada has published a Hydrogen strategy which outlined its ambition to transition to a Hydrogen economy as part of its net zero agenda by 2030 and beyond. Canada’s ambition can be summarised as follows (Natural Resources Canada 2020):

- Hydrogen delivering 30% of Canada’s 2050’s energy mix

- Canada becoming a net exporter of Hydrogen

Relevant Theoretical Frameworks

- Diffusion of Innovation Theory:

This theory states that new innovative products or ideas are not accepted immediately rather it spreads in stages and gradually (Franceschinis et al. 2017).

- Cost of production/labour theory of value:

This economic theory simply states that the value of any commodity is the sum total of its cost of production including labour (Işıkara and Mokre 2022).

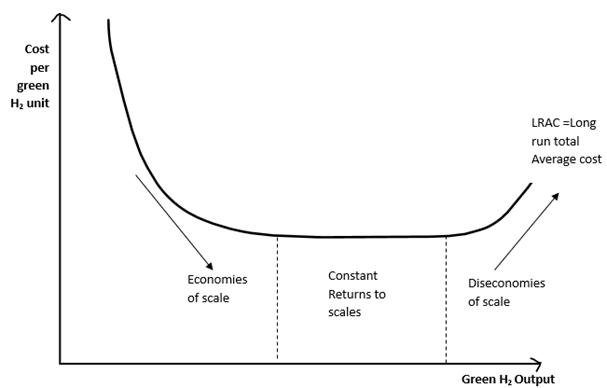

- Economies of scale:

This theory simply states that the increased production of a commodity will result to a decrease in price overtime.

Figure: Economies of scale by author

Challenges to Hydrogen Economy transitioning

Despite Canada’s very ambitious plan, they still have obstacles towards achieving their 2030 and 2050 net zero targets. Some of the challenges Canada face in transitioning to a Hydrogen economy includes:

- Hydrogen delivery cost: Transporting Hydrogen is a very complex process that increases the transaction cost of Hydrogen.

Pipeline delivery is the recommended cost-effective method of transporting Hydrogen over long distance from the site of production (Office of Energy Efficiency & Renewable Energy n.d.). But the process involves liquefaction which is energy (and capital) intensive and it also means that temperature must be kept low throughout the transportation process. Also, this is regulated by Canadian Transportation of dangerous goods Act (Government of Canada 2019) which is also a barrier. The final cost of the Hydrogen fuel for the final consumer will factor all of these costs of delivery and production according to the cost of production theory of value. All of these transaction costs make Hydrogen less competitive when compared to fossil fuel. As shown in figure 16. Canada’s cost of producing Hydrogen is even cheaper than the transportation cost in some regions which impacts on the final $/kg h2 cost of the fuel. Although Gim and Yoon (2012) used Korea as a case study in their research, Canada can as well leverage on economies of scale to drive down the delivery cost of Hydrogen per unit. This means that Canada will have to construct more network of Hydrogen pipelines to increase the scale of delivery and redistributing the fixed cost as more volume of Hydrogen is transported. But the cost and resources needed to build such infrastructure is high which will affect the value and cost of the produced Hydrogen at least in the short term according to the cost of production theory of value.

- Hydrogen cost of production:

Using the same Cost of production theory of production and also making reference to figure 16,Canada could leverage on economies of scale to bring down the cost curve of green Hydrogen making the fuel both competitive against fossil fuel. Unfortunately, Canada cannot leverage on its Levelised Cost of Renewable energy electricity to produce globally competitive green Hydrogen as blue and grey Hydrogen remains cheaper and the prevalent method of producing Hydrogen today.

Also, Hydrogen gas is five times more expensive than natural gas in Canada (Razi and Dincer 2022). However, BloombergNEF predicts that by 2030, Green Hydrogen will become cheaper than Blue Hydrogen in many countries even in USA with cheap gas.

- Technology adoption:

The Government of Canada noted that although Hydrogen fuel can be used in diverse application, they are currently focused on its adoption in energy intensive systems like in steel and cement manufacturing (Government of Canada 2023). The opportunity cost of transitioning to a hydrogen economy for an oil and gas producing nation like Canada will be in the abandonment and decommissioning of existing infrastructure for Hydrogen fuel adoption. Application of Diffusion of Innovation Theory means that it will take time before the majority of users and stakeholders adopt this technology. This is a challenge for Canada who is already well established in the use of oil and gas.

- Hydrogen storage:

Since Hydrogen is a very light and volatile gas, it can be stored only in pressurised cylinders or storage tank. It can also be stored under very low temperature in liquid form through liquefaction process. There are other promising chemical and technical hydrogen storage process that are yet to be commercialised. The challenges associated with these processes, as Meda et al. (2023) noted, adds to the transaction costs in production and transportation of Hydrogen which increases the cost of Hydrogen compared to Natural gas.

- End point utilisation cost:

Hydrogen fuel vehicles are known as Fuel cell Electric Vehicles (FCEVs) which are similar to Battery Electric Vehicles (BEVs) except for the source of energy. Plug-in Hybrid Electric Vehicle (PHEVs) is another less carbon intensive preference for energy transition (Molaeimanesh and Torabi 2023). As the diffusion of innovation theory implies, the adoption of FCEVs is still low as the industry lifecycle climbs to maturity. Unlike BEVs and PHEVs, the cost of FCEVs is very high due to the low demand and low supply which means that manufacturers cannot leverage on economies of scale to drive down the cost of production (Razi and Dincer 2022). This high-end point utilisation cost of produced Hydrogen is still a challenge to Canada.

Conclusion

In conclusion, Canada appears to be on the right track in transitioning to a Hydrogen Economy. Further investments and the use of relevant Government regulations will help speed up the adoption of Hydrogen as an energy carrier for diverse applications which will boost the demand and supply of the gas and drive down the cost curve as a result of economies of scale. This will help Canada achieve its vision of becoming a net exporter of green Hydrogen by 2030.

References

BloombergNEF 2021. ‘Green’ Hydrogen to Outcompete ‘Blue’ Everywhere by 2030. BloombergNEF [online]. May 5. Available from: https://about.bnef.com/blog/green-hydrogen-to-outcompete-blue-everywhere-by-2030/ [Accessed: 9 December 2023].

CALDARA, D., CAVALLO, M. and IACOVIELLO, M., 2019. Oil price elasticities and oil price fluctuations. Journal of Monetary Economics, 103, pp. 1-20.

Canada Energy Regulator 2023. Crude Oil Export Summary. Canada Energy Regulator [online]. 24 August. Available from: https://www.cer-rec.gc.ca/en/data-analysis/energy-commodities/crude-oil-petroleum-products/statistics/crude-oil-export-summary/index.html [Accessed: 2 December 2023].

CARRINGTON D., and STOCKTON B. 2023. Cop28 president says there is ‘no science’ behind demands for phase-out of fossil fuels. The Guardian [online] 3 December. Available from: https://www.theguardian.com/environment/2023/dec/03/back-into-caves-cop28-president-dismisses-phase-out-of-fossil-fuels [Accessed: 4 December 2023].

CECCO, L., 2023. ‘They’re destroying us’: Indigenous communities fear toxic leaks from Canada oil industry. The Guardian [online] 23 April. Available from: https://www.theguardian.com/world/2023/apr/23/canada-indigenous-communities-fear-toxic-leaks-canada-oil-industry-tailings-ponds [Accessed: 5 December 2023].

DOKAS, I. et al., 2023. Macroeconomic and Uncertainty Shocks and Effects on Energy Prices: A Comprehensive Literature Review. Energies, 16(3),

EIA.GOV 2023. What countries are the top producers and consumers of oil? EIA.GOV. [online]. 22 September. Available from: https://www.EIA.GOV/tools/faqs/faq.php?id=709&t=6 [Accessed: 2 December 2023].

FRANCESCHINIS, C. et al., 2017. Adoption of renewable heating systems: An empirical test of the diffusion of innovation theory. Energy (Oxford), 125, pp. 313-326.

GAZDA, J., 2010. REAL BUSINESS CYCLE THEORY – METHODOLOGY AND TOOLS. Economics & sociology, 3(1), pp. 42-48.

GIM, B. and YOON, W.L., 2012. Analysis of the economy of scale and estimation of the future hydrogen production costs at on-site hydrogen refueling stations in Korea. International Journal of Hydrogen Energy, 37(24), pp. 19138-19145.

GORDON, J., and SMITH F. 2022. Bank of Canada expected to push interest rates into restrictive territory. Reuters [online] 2 September. Available from: https://www.reuters.com/markets/us/bank-canada-expected-push-interest-rates-into-restrictive-territory-2022-09-01/ [Accessed: 4 December 2023].

GOV.UK 2023. Hundreds of new North Sea oil and gas licences to boost British energy independence and grow the economy. GOV.UK [online]. 31 July. Available from: https://www.gov.uk/government/news/hundreds-of-new-north-sea-oil-and-gas-licences-to-boost-british-energy-independence-and-grow-the-economy-31-july-2023 [Accessed: 4 December 2023].

Government of Canada 2016. The Paris Agreement. Government of Canada. [online]. 6 January. Available from: https://www.canada.ca/en/environment-climate-change/services/climate-change/paris-agreement.html [Accessed: 9 December 2023].

Government of Canada 2019. Transportation of Dangerous Goods Act, 1992 (S.C. 1992, c. 34). Government of Canada. [online]. 28 August. Available from: https://laws-lois.justice.gc.ca/eng/acts/T-19.01/ [Accessed: 9 December 2023].

Government of Canada 2022. Canadian Net-Zero Emissions Accountability Act. Government of Canada. [online]. 29 March. Available from: https://www.canada.ca/en/services/environment/weather/climatechange/climate-plan/net-zero-emissions-2050/canadian-net-zero-emissions-accountability-act.html [Accessed: 5 December 2023].

Government of Canada 2023. 2030 Emissions Reduction Plan: Clean Air, Strong Economy. Government of Canada. [online]. 7 December. Available from: https://www.canada.ca/en/services/environment/weather/climatechange/climate-plan/climate-plan-overview/emissions-reduction-2030.html [Accessed: 10 December 2023].

Government of Canada 2023. Net-zero emissions by 2050. Government of Canada. [online]. 27 October. Available from: https://www.canada.ca/en/services/environment/weather/climatechange/climate-plan/net-zero-emissions-2050.html [Accessed: 2 December 2023].

Government of Canada 2023. Using hydrogen in Canada. Government of Canada. [online]. 19 September. Available from: https://natural-resources.canada.ca/our-natural-resources/energy-sources-distribution/clean-fuels/using-hydrogen-canada/23149 [Accessed: 9 December 2023].

HARVEY, F., 2023. Carbon pricing would raise trillions needed to tackle climate crisis, says IMF. The Guardian [online] 7 December. Available from: https://www.theguardian.com/environment/2023/dec/07/carbon-pricing-would-raise-trillions-needed-to-tackle-climate-crisis-says-imf [Accessed: 9 December 2023].

HOLODNY, E., 2016. 155 years of oil prices – in one chart. World Economic Forum [online] 22 December. Available from: https://www.weforum.org/agenda/2016/12/155-years-of-oil-prices-in-one-chart/ [Accessed: 4 December 2023].

HOROWITZ, J., 2020. Covid-19 dealt a shock to the world’s top economies. Here’s who has fared the worst. CNN [online] 28 August. Available from: https://edition.cnn.com/2020/08/28/economy/global-recession-g7-countries/index.html [Accessed: 2 December 2023].

IEA 2023. Carbon Capture, Utilisation and Storage. IEA [online]. 11 July. Available from: https://www.iea.org/energy-system/carbon-capture-utilisation-and-storage [Accessed: 5 December 2023].

IEA 2023. Global Hydrogen Review. IEA

IEA 2023. Greenhouse Gas Emissions from Energy Data Explorer. IEA [online]. 2 August. Available from: https://www.iea.org/data-and-statistics/data-tools/greenhouse-gas-emissions-from-energy-data-explorer [Accessed: 4 December 2023].

IŞIKARA, G. and MOKRE, P., 2022. Price-Value Deviations and the Labour Theory of Value: Evidence from 42 Countries, 2000–2017. Review of Political Economy, 34(1), pp. 165-180.

JAAKKOLA, N., 2019. Carbon taxation, OPEC and the end of oil. Journal of Environmental Economics and Management, 94, pp. 101-117.

KILIAN, L., 2022. Understanding the estimation of oil demand and oil supply elasticities. Energy Economics, 107, pp. 105844.

LAMORTE, W., 2022. Diffusion of Innovation Theory. Boston University [online]. November 3. Available from: https://sphweb.bumc.bu.edu/otlt/mph-modules/sb/behavioralchangetheories/behavioralchangetheories4.html [Accessed: 9 December 2023].

LYNAS, M., HOULTON, B.Z. and PERRY, S., 2021. Greater than 99% consensus on human caused climate change in the peer-reviewed scientific literature. Environmental research letters, 16(11), pp. 114005.

MEDA, U.S. et al., 2023. Challenges associated with hydrogen storage systems due to the hydrogen embrittlement of high strength steels. International Journal of Hydrogen Energy, 48(47), pp. 17894-17913.

MOHAN, P., STROBL, E. and WATSON, P., 2021. Innovation, market failures and policy implications of KIBS firms: The case of Trinidad and Tobago’s oil and gas sector. Energy Policy, 153, pp. 112250.

MOLAEIMANESH, G.R. and TORABI, F., 2023. Chapter 5 – Fuel cell electric vehicles (FCEVs). In: G.R. MOLAEIMANESH and F. TORABI, eds. Fuel Cell Modeling and Simulation. Elsevier. pp. 283-301.

MURADOV, N.Z. and VEZIROǦLU, T.N., 2005. From hydrocarbon to hydrogen–carbon to hydrogen economy. International Journal of Hydrogen Energy, 30(3), pp. 225-237.

NATURAL RESOURCES CANADA, 2020. Hydrogen Strategy for Canada. Ottawa: Natural Resources Canada.

OCENIC, E.L. and TANTAU, A., Redefining the Hydrogen “Colours” based on Carbon Dioxide Emissions: A New Evidence-Based Colour Code.

OFFICE OF ENERGY EFFICIENCY & RENEWABLE ENERGY, n.d. Hydrogen delivery. Washington: Office of Energy Efficiency & Renewable Energy

OKUNLOLA, A. et al., 2022. Techno-economic assessment of low-carbon hydrogen export from Western Canada to Eastern Canada, the USA, the Asia-Pacific, and Europe. International Journal of Hydrogen Energy, 47(10), pp. 6453-6477.

OLIVER, M.E., 2015. Economies of scale and scope in expansion of the U.S. natural gas pipeline network. Energy Economics, 52, pp. 265-276.

PIANTA, S., RINSCHEID, A. and WEBER, E.U., 2021. Carbon Capture and Storage in the United States: Perceptions, preferences, and lessons for policy. Energy Policy, 151, pp. 112149.

RAMESH, S., 2019. Market failure. [online video]. Available from: https://hstalks.com/bm/4068/

RAZI, F. and DINCER, I., 2022. Challenges, opportunities and future directions in hydrogen sector development in Canada. International Journal of Hydrogen Energy, 47(15), pp. 9083-9102.

REDMOND, W., 2018. Marketing Systems and Market Failure: A Macromarketing Appraisal. Journal of macromarketing, 38(4), pp. 415-424.

REED, S., and KRAUSS, C., 2021. Too Much Oil: How a Barrel Came to Be Worth Less Than Nothing. New York Times. [online]. 28 September. Available from: https://www.nytimes.com/2020/04/20/business/oil-prices.html [Accessed: 5 December 2023].

TAHMASSEBI, H., 1986. The impact of the Iran-Iraq war on the world oil market. Energy, 11(4), pp. 409-411.

The Economist 2023. Rishi Sunak’s anti-green turn on Britain’s climate targets. The Economist [online]. 20 September. Available from: https://www.economist.com/britain/2023/09/20/rishi-sunaks-anti-green-turn-on-britains-climate-targets [Accessed: 6 December 2023].

The World Bank 2010. Export supply side. The World Bank [online]. Available from: https://wits.worldbank.org/wits/wits/witshelp/Content/SMART/Export%20supply%20side.htm [Accessed: 13 December 2023].

VAN RENSSEN, S., 2020. The hydrogen solution? Nature Climate Change, 10(9), pp. 799-801.

BP 2023. Country insight – US. BP. [online]. 1 February. Available from: https://www.bp.com/en/global/corporate/energy-economics/energy-outlook/country-and-regional-insights/us-insights.html [Accessed: 6 December 2023].

NATURAL RESOURCES CANADA, 2023. Energy Fact Book 2023 – 2-24. Ottawa: Natural Resources Canada.